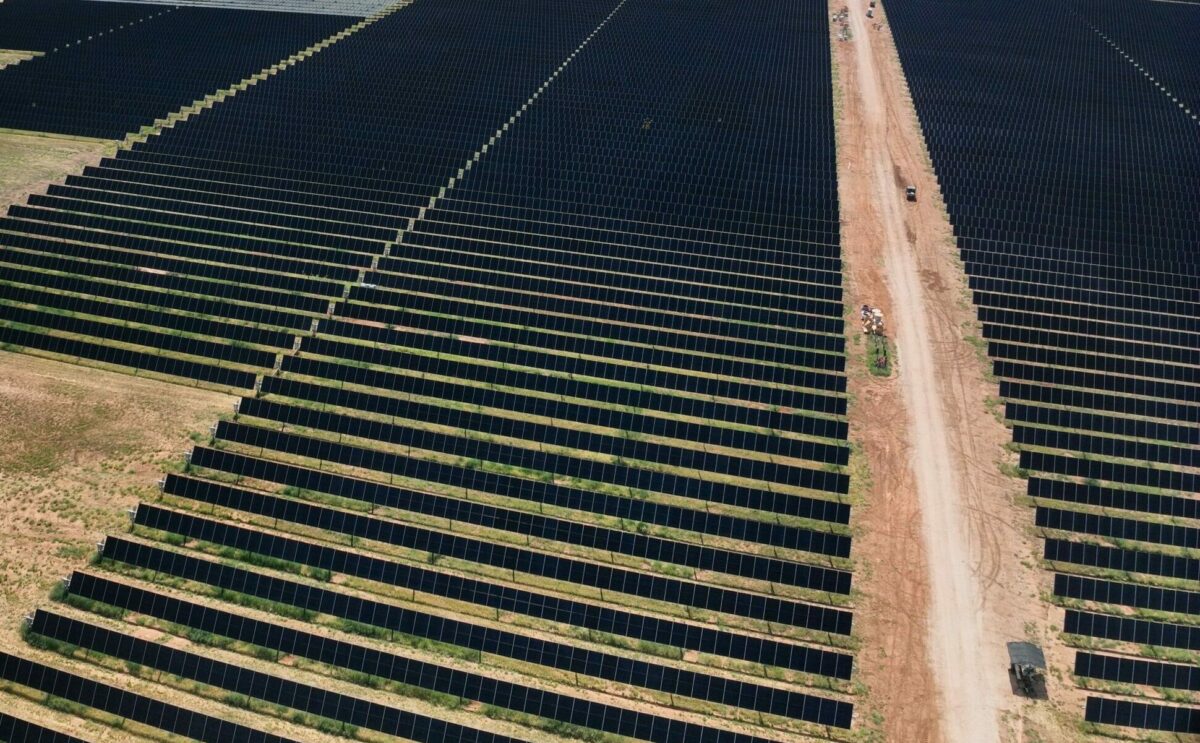

Financing secured for two new Texas solar farms

Lightsource bp completes $348 million financing package for two utility-scale solar projects in Texas

- 288 megawatts of new solar capacity will generate enough electricity to reliably power 50,000 homes

- Financing includes a suite of transferability facilities made possible by the Inflation Reduction Act

- Projects to bring additional energy security and diversification to the Texas electric grid.

Lightsource bp has successfully closed on a $348 million financing package, which will support the construction and operation of a 288-megawatt (MWdc) portfolio comprised of two utility-scale solar projects in Texas:

- 163MW Starr Solar project located in Starr County, Texas

- 125MW Second Division Solar project located in Brazoria County, Texas

Construction of both solar farms is underway, creating a combined 400 jobs during construction, with both projects scheduled to come online in 2024.

Emilie Wangerman, Head of USA, Chief Operating Officer (interim), Lightsource bp commented: “This deal is an important milestone towards building out our growing portfolio of solar and storage projects across the United States, extending our relationship with several top-tier financing counterparties, each of whom have partnered with Lightsource bp on previous transactions. It’s also our first transaction to benefit from the transferability provisions of the Inflation Reduction Act of 2022 to monetize the projects’ investment tax credits.”

Simms Duncan, Senior Vice President, Structured Finance, Lightsource bp, added: “We also believe that this deal is the first U.S. renewable energy project finance transaction to include both a transferability bridge loan and an equity partner bridge loan allowing Lightsource bp and its lenders to maintain their positions as market leaders.”

Supported by world-class finance partners

The Lightsource bp team has raised over $4.6 billion of third-party capital since 2019, supporting the commercialization of their U.S. renewable energy projects. The following Lenders arranged and provided the debt facilities related to this financing:

- Societe Generale served as the Coordinating Lead Arranger and Hedge Provider. This financing marked Societe Generale’s sixth transaction supporting Lightsource bp’s renewable energy projects in the USA. Societe Generale is one of Europe’s leading financial services groups and a major player in the economy for over 150 years. Societe Generale supports 25 million clients in over 60 countries.

- ING (ING Capital LLC and affiliates) served as a Mandated Lead Arranger, Hedge Provider, Green Loan Coordinator, as well as the Administrative Agent and Collateral Agent. This financing marked ING’s fifth transaction supporting Lightsource bp’s renewable energy projects in the USA. ING is a global financial institution with a strong European base. Its purpose is: empowering people to stay a step ahead in life and in business. ING’s more than 59,000 employees offer retail and wholesale banking services to customers in over 40 countries.

- NatWest, a leading UK-based financial services group with a growing multibillion U.S. Project Finance franchise and long-standing partner of Lightsource bp globally. This financing marks NatWest’s seventh transaction supporting Lightsource bp’s renewable energy projects in the USA. They are a major retail and commercial bank that provides global market access and trading, financing, risk management and transaction banking services. In October 2021 NatWest Group announced an additional £100 billion for Climate and Sustainable Funding and Financing by the end of 2025.

- Lloyds Banking Group (Lloyds Bank) served as a Mandated Lead Arranger and Hedge Provider. This financing marked Lloyds Bank’s third transaction supporting Lightsource bp’s renewable energy projects in the USA. Lloyds Bank is the UK’s largest financial services provider with more than 26 million customers and has mandate to create a more sustainable and inclusive future for people and businesses, by shaping finance as a force for good.

- Allied Irish Banks (AIB) served as a Mandated Lead Arranger. This financing marked AIB’s second transaction supporting Lightsource bp’s renewable energy projects in the USA. AIB is a financial services group operating in Europe, the UK and North America. AIB’s Project Finance team is made up of 65 professionals working from offices in Dublin, London and New York. AIB recently announced an increase in its Climate Action Fund to €30 billion to help support customers like Lightsource bp in building the green infrastructure of the future.

Investing in energy security for Texans

Once complete, the Starr and Second Division Solar projects will join Lightsource bp’s operational fleet, bringing additional diversification to the Texas electric grid, especially important during extreme weather conditions.

Lightsource bp currently operates three solar projects in Texas: 260MW Impact, 163MW Elm Branch and 153MW Briar Creek Solar. The projects are real-life examples of the value of a diversified, integrated energy approach for our energy security and reliability.

- Three years ago, during Uri, the worst winter storm in decades, the Impact Solar project (Lightsource bp’s only commercially operational project in Texas at the time) was operating and produced enough electricity to power more than 10,000 homes.

- In the summer of 2023’s heatwaves, all three projects were operating, keeping the lights on and air conditioners running for Texas families while helping alleviate electricity price spikes.

- During recent January 2024’s winter storm Heather, the projects operated at 99% availability, an extraordinary achievement in harsh conditions.

Resources

Starr Solar project website

Second Division Solar project website

Withstanding extreme weather on solar farms video

Recent news from Lightsource bp

13 Jan, 2026

Lightsource bp and Toyota enter into a power contract in Texas

Lightsource bp and Toyota Motor North America have finalized a virtual power purchase agreement for energy from the 231MW Jones City 2 solar farm in Texas.

14 Oct, 2025

Lightsource bp and Pinnacle Financial Partners announce $97.9M tax equity deal for Peacock Solar

Lightsource bp and Pinnacle Financial Partners today announced the closing of a $97.9 million tax equity deal to finance the 187 MW Peacock Solar in San Patricio County, TX.

15 Aug, 2025

Lightsource bp wins two North American Agrivoltaics Awards

Lightsource bp proudly announces receipt of two North American Agrivoltaics Awards: Solar Ranch of the Year and Champion of the Year.