$140 million tax equity deal with Barclays

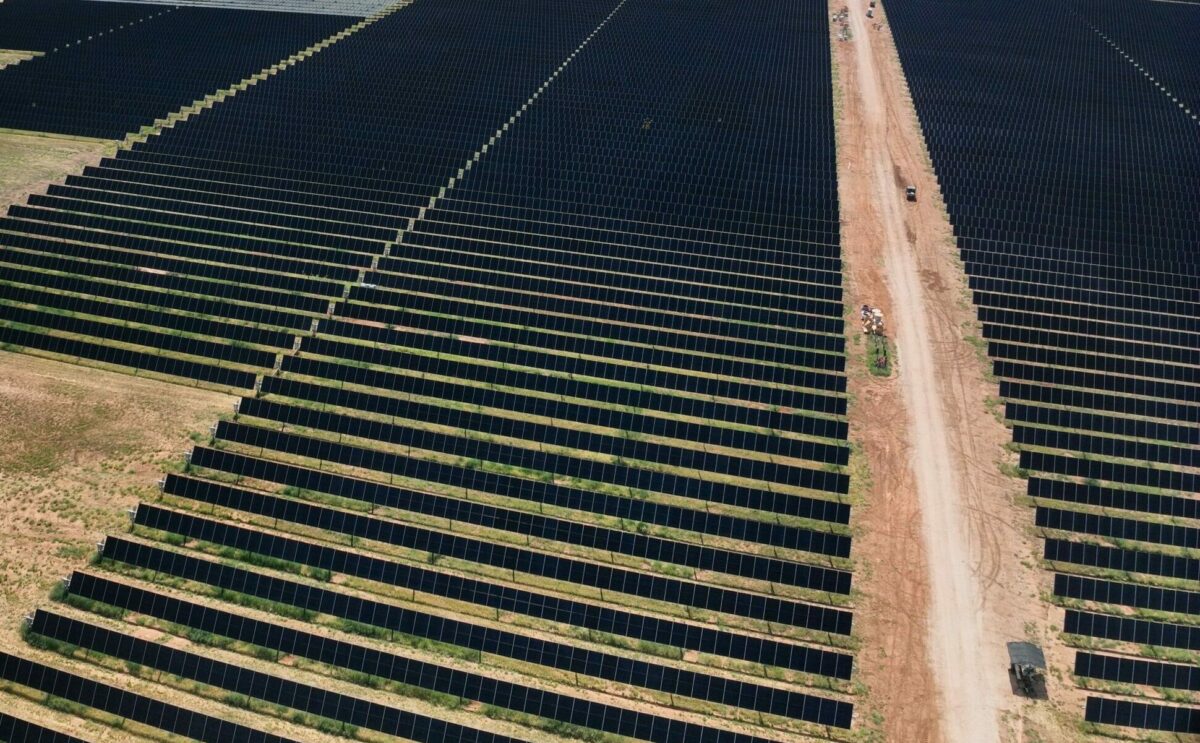

Barclays and Lightsource bp agree $140 million tax equity deal for solar project in St. Landry Parish, Louisiana

- Prairie Ronde 180MWdc solar farm will generate enough energy to power equivalent of 31,000 homes

- The project will create 250 new jobs during construction, supporting local workers

Barclays and Lightsource bp announced today that they have committed to a $140 million tax equity deal which will finance the construction of the Prairie Ronde 180MWdc solar project in St. Landry Parish, Louisiana.

The deal is one of the first to be led by Barclays’ new Sustainable Project Finance team, working in partnership with the bank’s Energy Transition Group, which was formed last month to provide strategic advice to clients as they explore energy transition opportunities. Barclays acted as the sole external equity investor on the $140 million tax equity deal, which will contribute towards the bank’s target to facilitate $1 trillion of Sustainable and Transition Financing between 2023 and the end of 2030.

Lightsource bp plans to build, own, and operate the solar farm, which will create 250 new jobs during construction, supporting local workers and domestic supply chains. Commercial operation of the project is expected to begin in late 2024.

Once completed, the project holds significant benefits for the St. Landry Parish community. Lightsource bp has committed to dedicating $250,000 in funds to philanthropic activities and charity donations to local St. Landry Parish organizations. They have also committed to increasing biodiversity on the land, working in partnership with local experts to grow a variety of beneficial plants under and around the solar panels.

Lightsource bp has already agreed a power purchase deal with McDonald’s Corporation. The amount of solar energy the project will generate is enough to power over 600 McDonald’s restaurants with renewable electricity annually.

Jessie Bellard, St. Landry Parish President, said: “Lightsource bp’s investment in St. Landry Parish represents a new day for our community and our schools. Their funding boosts job-creating development projects, stronger infrastructure, and better education for our children. With this support, St. Landry Parish is poised to become a regional leader in innovation and opportunity for all.”

Emilie Wangerman, Head of USA, Chief Operating Officer (interim) at Lightsource bp, said: “As members of the St. Landry community, we look forward to delivering affordable clean energy while continuing to expand our investment in Louisiana to help power the state’s low carbon, independent energy future. What’s really exciting is commitments like Barclays to sustainable and energy transition financing are also helping boost local economies. The Prairie Ronde project is expected to provide more than $20 million tax revenue to St. Landry Parish public services such as local school systems over the life of the project.”

James Edmonds, Barclays Global Head of Sustainable Project Finance, said: “We’re proud to have delivered this tax equity commitment which will provide huge benefits to the local community in St. Landry Parish. Barclays is fully committed to a just transition and working with key clients such as Lightsource bp to evaluate all economic and societal opportunities as we scale climate finance. Mobilizing strategic capital is critical for the energy transition and ensures Barclays can make a demonstrable difference in accelerating the scale up of clean energy development projects.”

Notes & Resources

- Barclays has a longstanding relationship with bp and Lightsource bp. The bank acted as Joint Financial Adviser to Lightsource bp on the sale of their 50.03% remaining interest to bp in November 2023.

- Barclays was one of the first global banks to announce a 2050 net-zero ambition and is committed to reducing its financed emissions in support of this.

- The bank has a target to facilitate $1 trillion of Sustainable and Transition Financing between 2023 and the end of 2030, encompassing the long-term Green, Social, Transition and broader Sustainable Financing requirements of clients.

- In 2020, Barclays announced its 2050 net zero ambition and subsequently set 2025 emissions targets for the Energy and Power sectors.

- Barclays has set additional 2030 targets that integrate the IEA’s Net Zero 2050 1.5°C-aligned temperature rise scenario in five of the highest emitting sectors in its financing portfolio – Energy, Power, Cement, Steel and Automotive Manufacturing. Further details can be found here

- The International Energy Agency (IEA) estimates that the amount of investment required to support the transition is $4.5 trillion a year.

Recent news from Lightsource bp

13 Jan, 2026

Lightsource bp and Toyota enter into a power contract in Texas

Lightsource bp and Toyota Motor North America have finalized a virtual power purchase agreement for energy from the 231MW Jones City 2 solar farm in Texas.

14 Oct, 2025

Lightsource bp and Pinnacle Financial Partners announce $97.9M tax equity deal for Peacock Solar

Lightsource bp and Pinnacle Financial Partners today announced the closing of a $97.9 million tax equity deal to finance the 187 MW Peacock Solar in San Patricio County, TX.

15 Aug, 2025

Lightsource bp wins two North American Agrivoltaics Awards

Lightsource bp proudly announces receipt of two North American Agrivoltaics Awards: Solar Ranch of the Year and Champion of the Year.