Hedging energy prices

Hedge contracts and renewable energy procurement

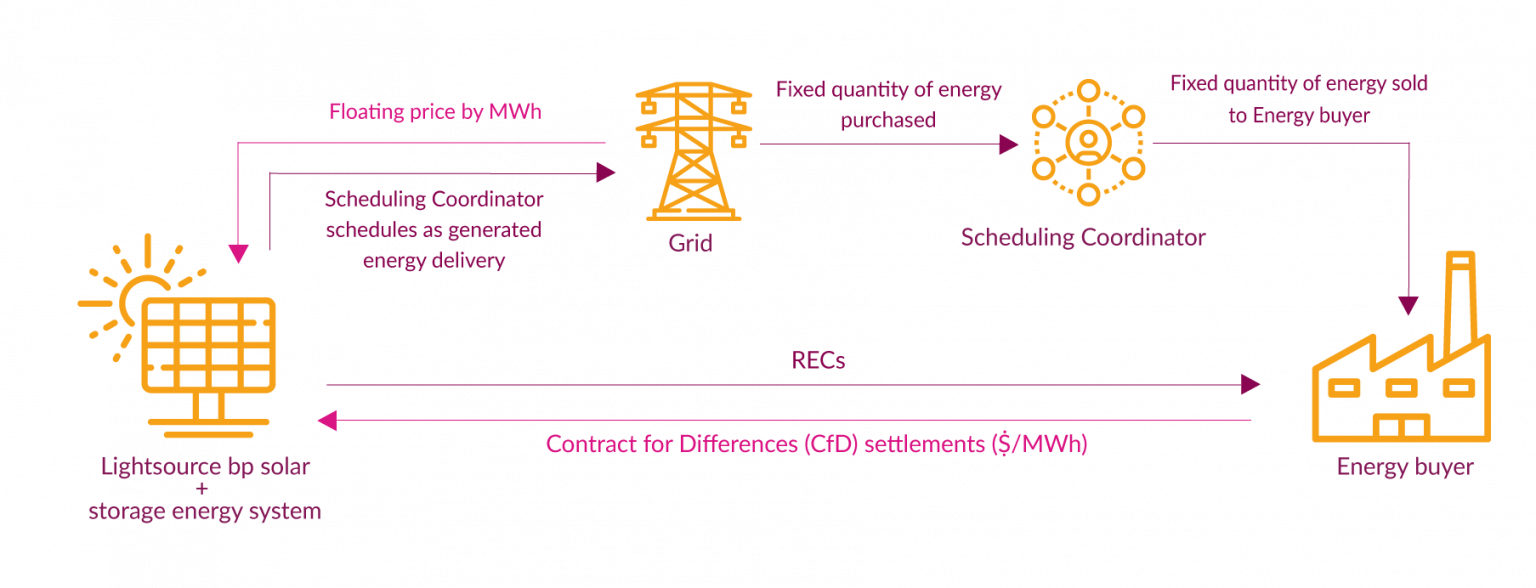

In a renewable energy contract with a hedge structure, Lightsource bp is committed for a fixed number of megawatt hours (MWhs) for every month over a set time period. This structure is different from a standard unit-contingent or as generated power purchase agreement (PPA) because it is a fixed shape. If the solar facility does not generate the committed number of MWhs, Lightsource bp must go out and buy electricity from the market to hit that committed value to the Energy Buyer. If the solar facility overproduces, Lightsource bp can sell those excess MWhs into the market.

Available products with a Hedge:

- Energy

- Environmental attributes

- Capacity

- Ancillary services

Location: Solar project can be located anywhere, but locating within settlement zone/hub reduces basis risk.

Typical customers: Swap or Hedge providers

Advantages:

- Cost savings

- Risk mitigation

- Long term electricity stability and predictability