Proxy generation PPA

What is a proxy generation power purchase agreement?

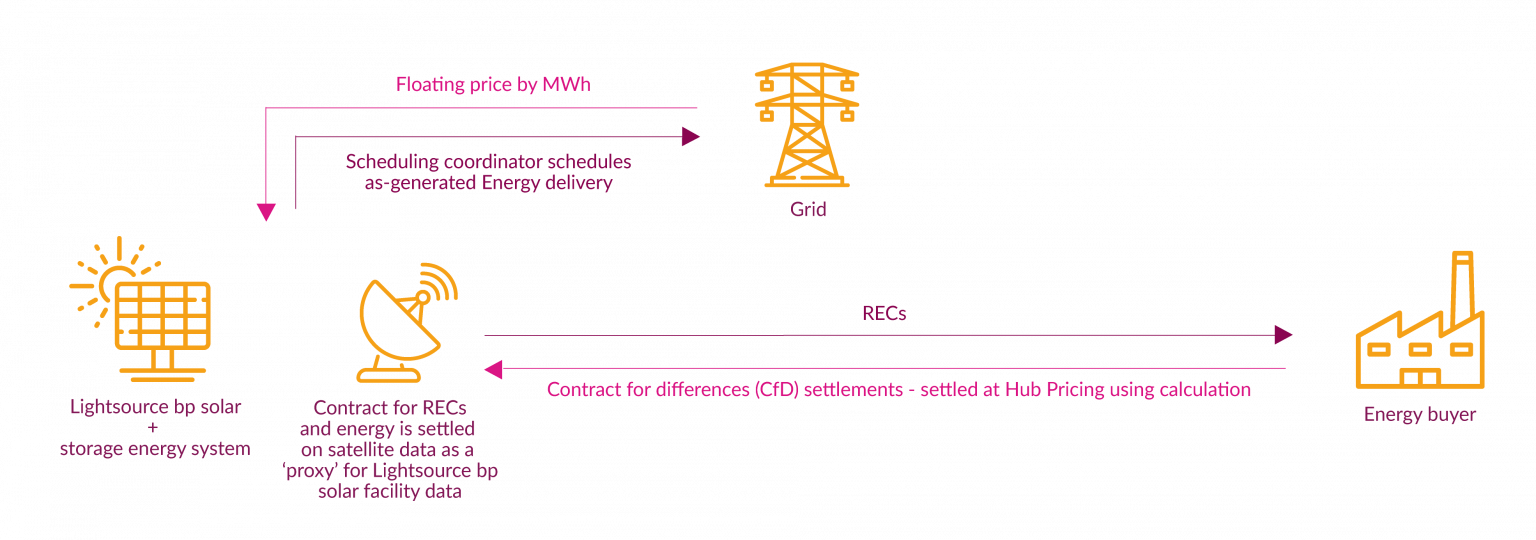

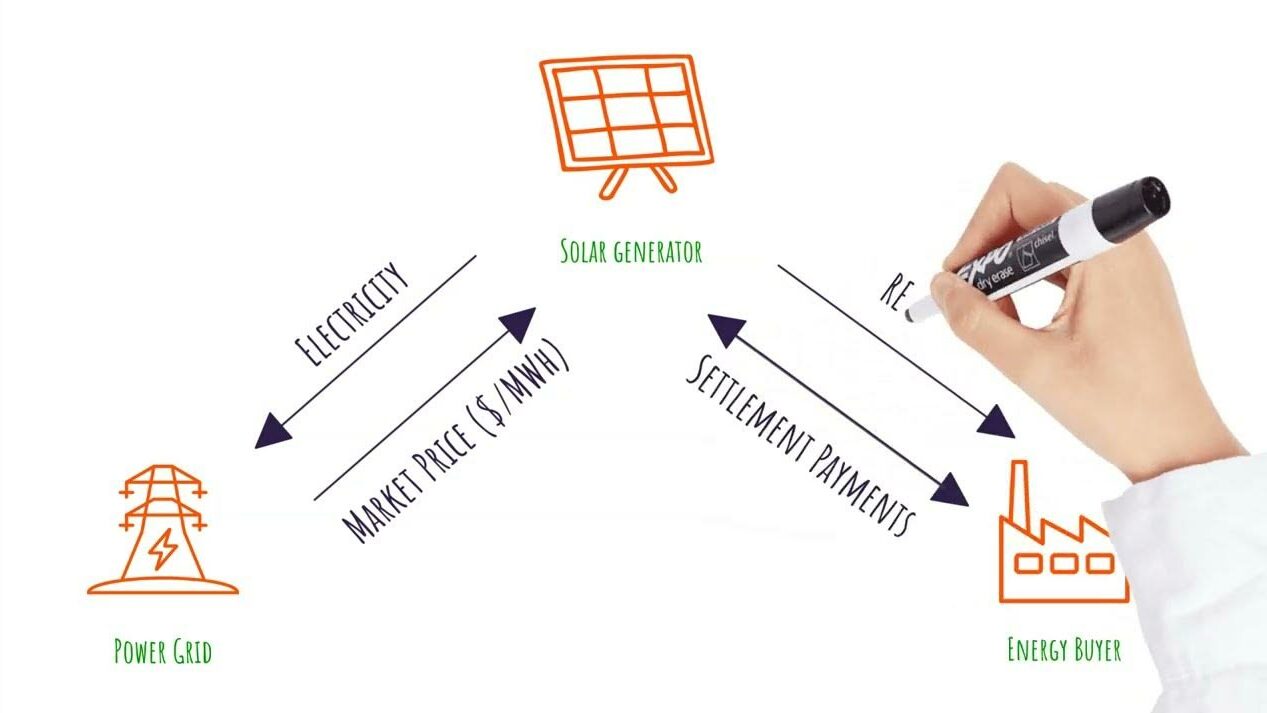

A proxy generation power purchase agreement (pgPPA) is an innovative renewable energy contract structure primarily intended to manage weather related risk. A pgPPA is similar to a virtual power purchase agreement (VPPA), except it settles energy on a proxy generation index rather than actual production of the solar and energy storage project (i.e., metered generation).

Proxy generation is an hourly index predetermined by a mathematical formula that estimates how many MWh should have been produced by the solar and storage energy system. It’s based on the solar irradiance as measured by the project’s operational and meteorological measurements, along with a rate of efficiency. This formula, along with underlying assumptions, is mutually agreed upon by the buyer and Lightsource bp before execution of the power purchase agreement.

The primary difference between a proxy generation PPA and a typical virtual PPA is that the proxy generation PPA settles based on the proxy generation rather than the actual output of the project. As with a VPPA, a pgPPA is often referred to as a ‘contract for differences’ as it is a financial contract where the buyer does not physically receive the electricity. The buyer agrees to purchase a solar plus energy storage project’s output and associated Renewable Energy Credits (RECs) at a set fixed price. Lightsource bp settles based on the comparison of market price and the contract’s strike price. When the market price is greater than the fixed pgPPA price, Lightsource bp passes the upside to the energy buyer. When the market price is less than the fixed pgPPA price, buyer must true up or pay Lightsource bp the difference.

Available products with a proxy generation PPA:

- Energy – based on settlements calculated by an independent settlement agent who evaluates solar irradiance and expected output

- Environmental attributes

- Capacity

- Ancillary services

Location: Solar project can be located anywhere, but locating within settlement zone/hub reduces basis risk.

Typical customers: Insurance companies, Power Trading, Retail Energy Suppliers, Corporates

Advantages:

- Cost savings

- Risk mitigation

- Long term electricity stability and predictability

Proxy Generation PPA case studies

Allianz Global Corporate & Specialty