$276 million tax equity investment

Lightsource bp closes first tax equity deal with Wells Fargo for 481 megawatt solar portfolio

$267 million financing leverages Production Tax Credit (PTC) structure made available for solar in the Inflation Reduction Act of 2022

San Francisco, CA (January 18, 2023): Lightsource bp has successfully closed on a $267 million tax equity investment from Fortune 500 Wells Fargo & Company (NYSE: WFC), a leading financial services company with approximately $1.9 trillion in assets. The tax equity investment by Wells Fargo is in addition to Lightsource bp’s sponsor equity investment and complements the debt financing package which originally closed in December 2021.

”We are pleased to support Lightsource bp in its efforts to supply low-cost, emission-free solar electricity in Louisiana and Arkansas,” said Shane Easter, a director with Wells Fargo’s Renewable Energy & Environmental Finance group. “Providing expertise and capital to important customers like Lightsource bp is part of our commitment to deploy $500 billion in sustainable financing by 2030 to support our customers and communities as they transition to a resilient, equitable and sustainable future.”

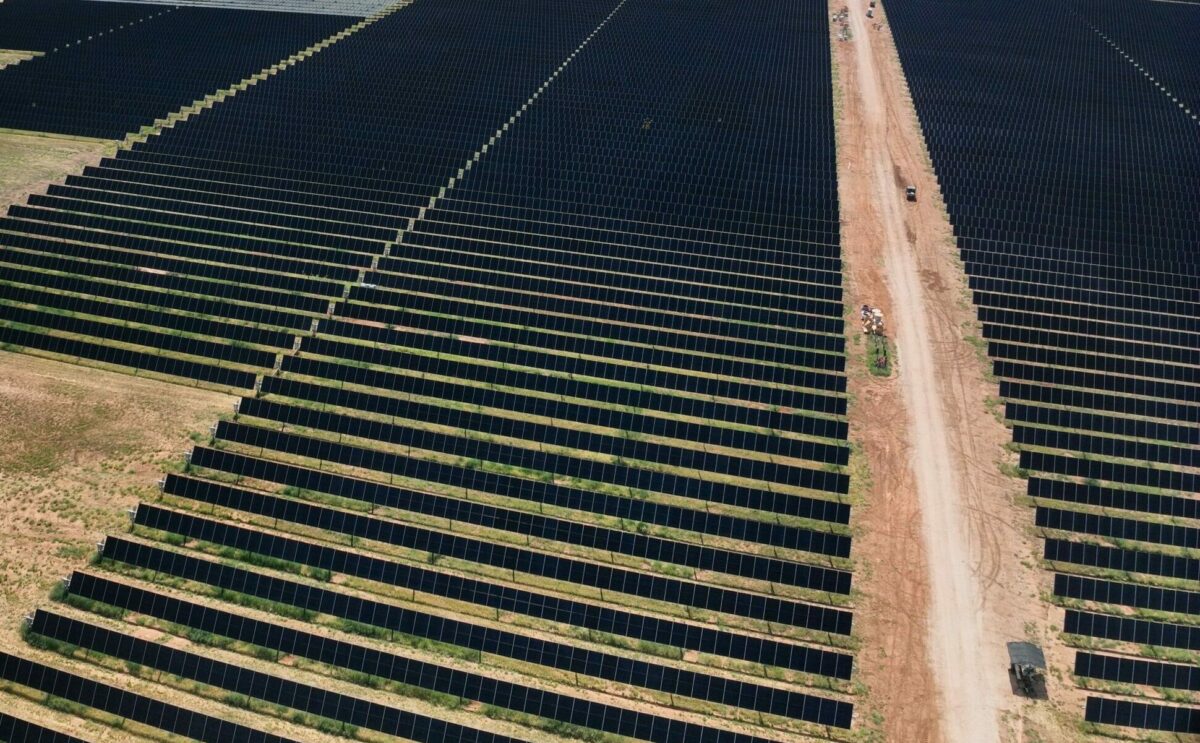

Well Fargo’s investment will support the construction and operation of a two-project portfolio totaling 481 megawatt dc (MW), which are among the largest projects in each state, and include:

- 346MW Oxbow Solar in Pointe Coupee Parish, Louisiana with energy sales to McDonald’s and eBay

- 135MW Conway Solar near Happy, Arkansas with energy sales to Conway Corp

As the tax equity investor, Wells Fargo is now the eighth global financial institution to support this portfolio of projects, joining the portfolio’s project finance lenders including HSBC Bank USA, ING Capital LLC, Societe Generale, NatWest, Intesa Sanpaolo, Standard Chartered Bank, and Allied Irish Banks.

Both projects are scheduled to come online starting in 2023, creating 600 direct construction jobs.

“This investment is a great example of the positive impact that top tier financial institutions with meaningful commitments to sustainability such as Wells Fargo can make to help accelerate our country’s transition to a low-carbon economy and reduce the impacts of climate change that affect lives and livelihoods”, said Kevin Smith, Lightsource bp’s CEO of the Americas. “The new tax credit options and stable policy environment for job growth made possible by the Inflation Reduction Act will further incentivize investment and spur the growth of America’s solar industry.”

Recent news & insights from Lightsource bp

13 Jan, 2026

Lightsource bp and Toyota enter into a power contract in Texas

Lightsource bp and Toyota Motor North America have finalized a virtual power purchase agreement for energy from the 231MW Jones City 2 solar farm in Texas.

14 Oct, 2025

Lightsource bp and Pinnacle Financial Partners announce $97.9M tax equity deal for Peacock Solar

Lightsource bp and Pinnacle Financial Partners today announced the closing of a $97.9 million tax equity deal to finance the 187 MW Peacock Solar in San Patricio County, TX.

15 Aug, 2025

Lightsource bp wins two North American Agrivoltaics Awards

Lightsource bp proudly announces receipt of two North American Agrivoltaics Awards: Solar Ranch of the Year and Champion of the Year.