Energy buyer’s guide part 4: The many advantages of the Inflation Reduction Act

Fourth article in a series by Emilie Wangerman, Head USA, COO:

What does the Inflation Reduction Act (IRA) do for buyers of renewable energy?

In my last article, I explained how businesses leverage their management teams to efficiently and effectively buy affordable renewable energy.

Now I’m turning to how businesses will benefit from the Inflation Reduction Act (IRA) President Biden signed into law on Aug. 16. This law will accelerate US clean energy development, create millions of jobs, reduce carbon emissions during a critical time for addressing global climate change, and stimulate new clean energy domestic manufacturing.

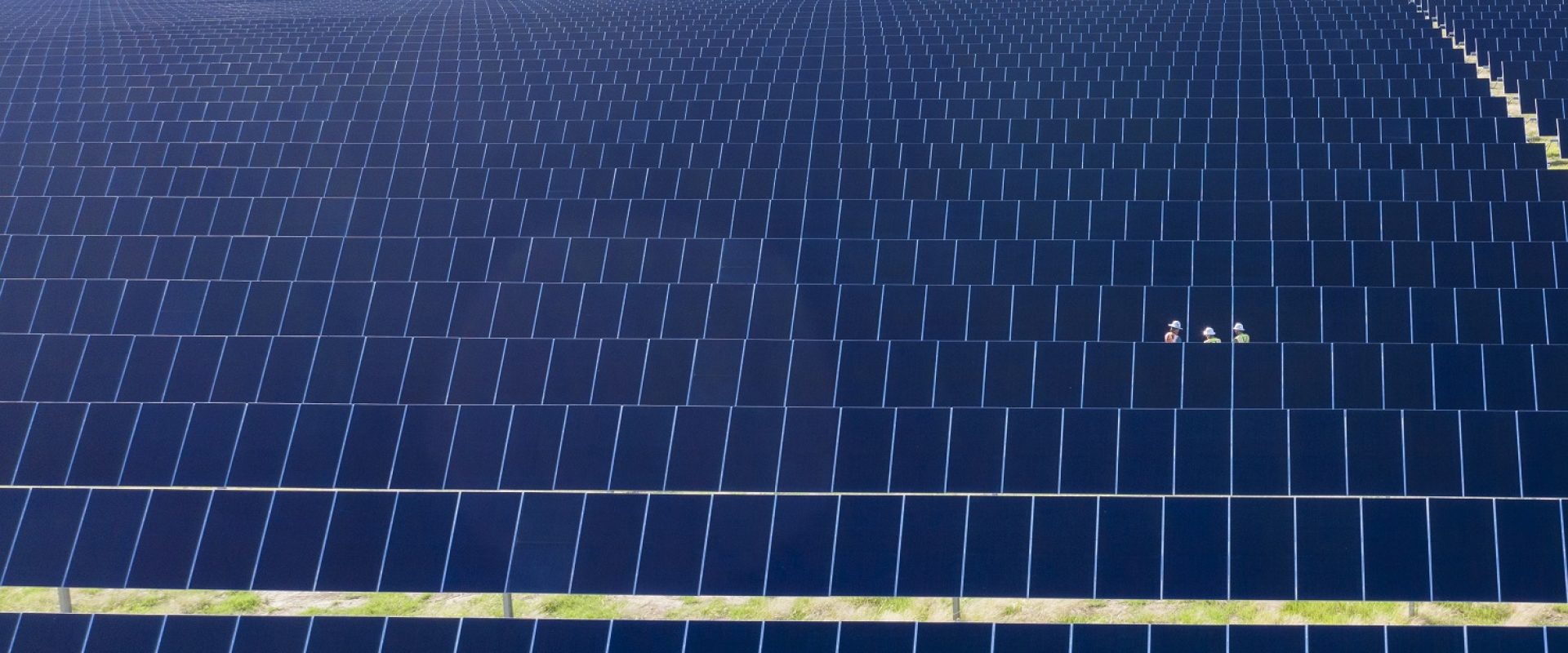

Solar energy has already made great strides in the U.S., growing from less than one gigawatt of total generating capacity in 2008 to over 97 gigawatts now. That progress, however, has been hampered by ever-increasing tariffs on Chinese-made modules and COVID related supply chain slowdowns. Additionally, the lack of sustained incentives from federal government has created an on-again, off-again uncertainty that made it difficult for US solar and wind industries to plan for the future.

The IRA will address many of these issues and cement a long-term future for US solar and wind. It will create 9 million US jobs in renewable energy in 10 years, give businesses more solar projects from which they can buy electricity, boost domestic manufacturing, and extend federal support for 10-years — which gives the industry stability and longevity. Manufacturers and developers can make major investments with confidence given this renewed certainty on cost recovery.

This bill is a much-needed long-term commitment by the federal government to the future of the U.S. renewable energy industry, and it is long overdue.

So, what does the IRA climate bill mean for clean energy buyers?

While all of this is promising, resist the urge to “wait and see.” Climate change is real now, and in a climate crisis, we don’t have time to wait. Maintain your commitment to procuring now and you’ll receive the benefits both now and later.

This bill does not reduce near-term costs for solar projects, which have risen over the last two plus years because of tariffs, supply shortages, high energy prices, and inflation. It does introduce opportunities for developers to restart projects that had been put on hold because of rising costs. More projects mean more choices for customers.

It also introduces long-term benefits from local manufacturing, local labor, and community enhancement. It gives incentives to use U.S. steel and to engage with communities in need of economic stimulus. These latter improvements will take time to implement. Hopefully these changes will coincide with lower costs as inflation subsides. Local manufacturing means less long-distance shipping, which will further reduce the costs for the already low-cost clean energy resource —helping you address climate change now and into the future.

U.S.-made components

For the next 10 years, the IRA will create manufacturing production tax credits for a wide range of solar components, including thin film photovoltaic cells and crystalline photovoltaic cells, photovoltaic wafers, solar grade polysilicon, polymeric backsheet, and solar modules.

According to an analysis by the Joint Committee on Taxation, the law will direct more than $30 billion over the next decade to U.S. makers of all types of components used in the renewable energy industry.

Before the law’s passage, many of these advances were just in the planning stages. For example, before the announcement of the agreement that led to the Inflation Reduction Act, REC Silicon was discussing reopening production at its Moses Lake polysilicon plant in Washington state.

Another U.S. manufacturer, Hanwha Qcells, said it was contemplating expanding its domestic production after the law’s passage.

First Solar, another major U.S. manufacturer, said the new law led it to reconsider its domestic manufacturing plans.

These steps mean a more reliable supply chain and a more robust U.S. industry, which will make it easier to develop more solar power and expand its availability around the country.

More projects

Customer demand is higher than ever as more employers seek clean solar-generated electricity to tackle the climate crisis. Unfortunately, some clean energy projects have been delayed or cancelled because of increasing EPC costs, transmission interconnection delays, and more costly financing.

The IRA addresses all three of these issues. It expands and extends the investment tax credit (ITC) and production tax credits (PTC) for solar projects. This longevity provides stability in project financing and enables developers to increase investment in portfolios and restart projects that were put on hold. Procurement and EPC costs may decline in the long run as manufacturing returns to the U.S. and customers benefit from U.S.-made solar products.

The apprenticeship provision invests in workforce development and can reduce EPC costs in the long run. Additionally, the IRA includes $2.9 billion in funding for the transmission system. This is good initial progress, and more is to come on transmission reform through FERC’s queue reform efforts and a possible second bill in the fall to address improvements in transmission permitting processes. Even more focus is still needed on local permitting barriers for solar projects, but that’s outside of the federal IRA law.

According to a Princeton University ZERO Lab analysis, solar will go from adding 10 GW in generating capacity to the U.S. grid in 2020 to 49 GW of capacity per year in 2025-26. That’s five times the current rate of new solar capacity additions.

Such growth means more competition in solar generation for consumers and an increased supply of renewable energy. The clean energy industry’s growth will benefit all Americans.

More jobs

Building a robust renewable energy economy means more high-quality jobs and lasting careers. The IRA rewards developers for paying prevailing wages for the laborers who build their projects and for developing them in brownfield communities that have suffered environmentally and economically.

Those jobs will come in manufacturing, engineering, plant development, law, communications, human resources, and all areas that make for successful businesses.

As we’ve seen with so many industries in this country, the more people employed by a certain industry, the more influential it becomes. Solar energy is at the beginning of this curve, and the Inflation Reduction Act will ensure its impact over the long-term.

It took us years to get to this point, and change won’t happen overnight. We continue to face rising cost pressures that have arisen during the COVID-19 pandemic and the war in Ukraine – inflation, supply chain disruptions, tariff risks, and high energy prices.

But the Inflation Reduction Act is finally a giant step forward, and one we’ve needed to take for years. I’m looking forward to a future enabled by this long-needed new law. Those of us committed to a cleaner future welcome this federal support, and I hope our solar customers will too.

Now we have it, and we’re not looking back.

Emilie Wangerman first published this article on LinkedIn in on August 23, 2022. To leave a comment or question, please view the original post here.

About the author:

Emilie Wangerman brings 13 years of energy industry experience across energy procurement, customer programs, operations, power marketing, acquisitions, and growth strategy to her role as the Head of USA, COO for Lightsource bp. She joined Lightsource bp in late 2017 to significantly accelerate expansion into the U.S. market. Since then, the U.S. team has developed more than 3.4GW of projects, raised more than $4 billion in project financing, and built a strong pipeline of over 30GW. During 6 years under Emilie’s leadership, the business development team executed more than 4GW of power contracts with a wide range of power purchasers that include universities, utilities and well-known brands such as McDonald’s, eBay, Verizon, and Amazon. The team also acquired over 15GW of projects to support the greenfield pipeline.

Prior to Lightsource bp, Emilie held leadership positions at Pacific Gas and Electric (“PG&E”) and Intel Corporation. Emilie received a Bachelor of Science in both Chemical Engineering and Psychology from Rensselaer Polytechnic Institute, a Master of Business Administration at Duke University’s Fuqua School of Business, and a Master of Environmental Management at the Nicholas School of the Environment.

Read Emilie’s leadership story here.

Partner with us: Energy Buyers

Discover how Lightsource bp works with largescale energy buyers to execute power purchase agreements customized to your business needs.

More from our Energy Buyer's Guide

09 Aug, 2022

Energy buyer’s guide part 3: Who do you need on your team for successful renewable energy procurement?

Article by Emilie Wangerman

09 Nov, 2022

Energy buyer’s guide part 5: Where are you buying clean energy?

Article by Emilie Wangerman

20 Dec, 2022

Energy buyer’s guide part 6: How much clean energy do you need?

Article by Emilie Wangerman